A Sharp Decline in Climate Tech Investments in 2023

Author: Arvin Khanchandani

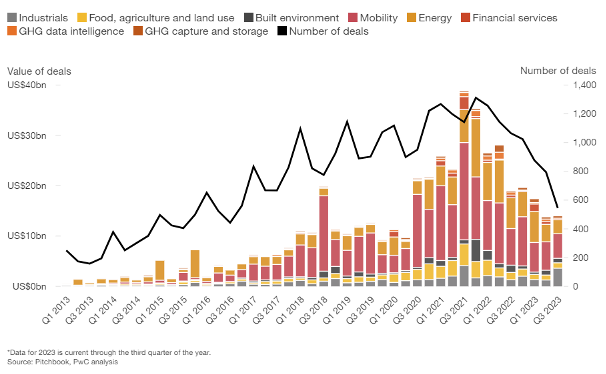

2023 proved challenging for Climate Tech investments, with a noticeable downtrend in both the global number and value of deals throughout the year. Although the final data for Q4 is pending, the first three quarters consistently reflected this decline. Particularly striking was the drop in deal numbers in Q3, falling below 600 – a figure reminiscent of 2017 levels.

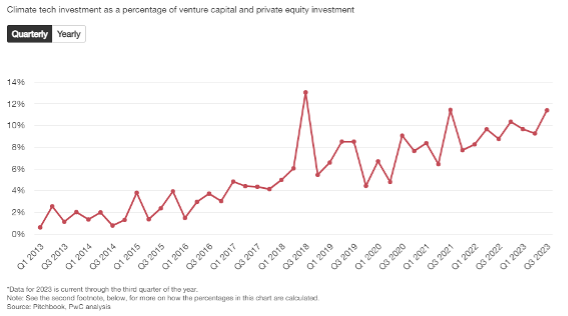

The downturn experienced in Climate Tech investments in 2023 should be viewed in the context of broader market trends. This sector’s decline was part of an overarching slump in the Venture Capital and Private Equity markets, largely attributed to prevailing macroeconomic uncertainties. Despite this general downturn, Climate Tech’s relative market position actually strengthened: its share of total investments rose to 11.4% in Q3 2023, up from 8.8% in the same quarter the previous year. This increase is part of a consistent upward trajectory observed over the past decade, highlighting Climate Tech’s growing prominence within the broader investment landscape.

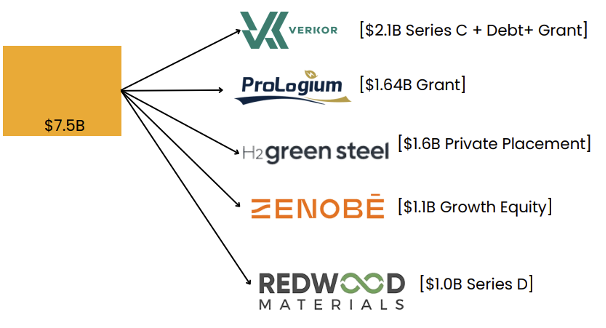

However, what is interesting is that Q3’ 2023 was also the quarter with the highest number of mega ($1bn+) Climate Tech rounds on record. Those include Verkor (French low-carbon batteries producer – $2.1bn), ProLogium (Taiwanese solid-state batteries producer – $1.6bn), H2 Green Steel (Swedish green steel producer – $1.6bn), Zenobe (British battery storage producer – $1.1bn), and Redwood Materials (US recycler of batteries – $1.0bn). May this trend continue!

What’s in store for Climate Tech in 2024?

Here are 3 quick predictions from me for Climate Tech in 2024.

1. Public and (hopefully) private investments in Climate Tech are set to rise. Public funding in 2024 will be seeing a substantial boost, with initiatives like the Inflation Reduction Act in the US moving from planning to the construction phase – a clear sign of progress. Similarly, the EU and its member states, like Germany with its €212bn climate fund (KTF) and other countries like France and Poland, are launching substantial public funding initiatives aimed at accelerating the green transition.

Private investment trends, however, present a more complex picture. The first half of 2024 is expected to see continued caution and selectivity among investors. This caution is influenced by potential unforeseen events and ongoing geopolitical conflicts, like the war in Ukraine. However, there are positive indicators suggesting that the macroeconomic environment may stabilize.

If this stabilization occurs, it’s anticipated that the latter half of 2024 will witness a significant increase in venture capital and private equity investments, positively impacting Climate Tech investments. This resurgence would mark a welcome shift following a period of uncertainty and could catalyze further growth and innovation in the Climate Tech sector.

2.Initiatives that began in the 2010s are now evolving from pilot or demonstration stages to commercial-scale operations. This shift is fueled by the increasing demand for products that aid in decarbonization from potential off-takers.

Key areas of focus include the development of green steel and cement, the production of e-fuels, advancements in carbon removal technologies, innovative energy storage solutions, and extensive recycling efforts encompassing batteries, plastics, tires, and biomass.

Financing these projects is challenging, given the inherent risks in funding first-of-a-kind (FOAK) endeavors. However, forward-thinking Climate Tech investors are recognizing the significant potential these projects hold. Not only do they offer a path to substantially decarbonize various industries, but they also present opportunities for remarkable financial returns.

3. Carbon accounting / ESG reporting software will become widely adopted. Projected to grow from $15.31 billion in 2023 to an impressive $64.39 billion by 2030, with a CAGR of 22.8%, this surge is largely driven by new regulations. In the EU, the Corporate Sustainability Reporting Directive (CSRD) is a key catalyst in this growth, mandating more comprehensive sustainability reporting.

Starting in 2025, all large European companies currently under the Non-Financial Reporting Directive will need to publish CSRD-compliant reports for the preceding financial year, beginning with 2024. This change will affect around 11,000 companies, significantly increasing the demand for robust ESG reporting tools.

Moreover, the impact of these regulations extends beyond large corporations. Even SMEs, slated to publish their first sustainability reports in 2027 (for the year 2026), are anticipated to start adopting ESG reporting software as early as 2024 to track sustainability KPIs. This broadening requirement signifies a major shift towards more transparent and accountable business practices in Europe, and a growing market for ESG reporting solutions.